Buy colored gemstones: Discover gemstone investment now!

Gemstones have been among humanity’s most coveted treasures for millennia. They fascinate with their unique luster, rare colors, and robust durability. This is one of the reasons why they have been considered a safe store of value for more than 5,000 years – and even today, colored gemstones such as aquamarine, emerald, and ruby continue to prove an attractive alternative for investors seeking tangible assets to diversify their wealth.

Below you will learn which factors influence the value development of gemstones, why this form of investment has a lasting appeal, and what comprehensive services the German Gemstone House offers you to make your investment in gemstones safe and transparent.

Our selection of investment colored gemstones

Important facts about gemstone investments

- Exclusive rarity : Only 2–3% of all gemstones are suitable as investments. The majority of mined colored gemstones are used for jewelry and are usually treated (chemically treated, heated, or radioactively irradiated).

- Investment gemstones are generally untreated, which increases their rarity and investment value.

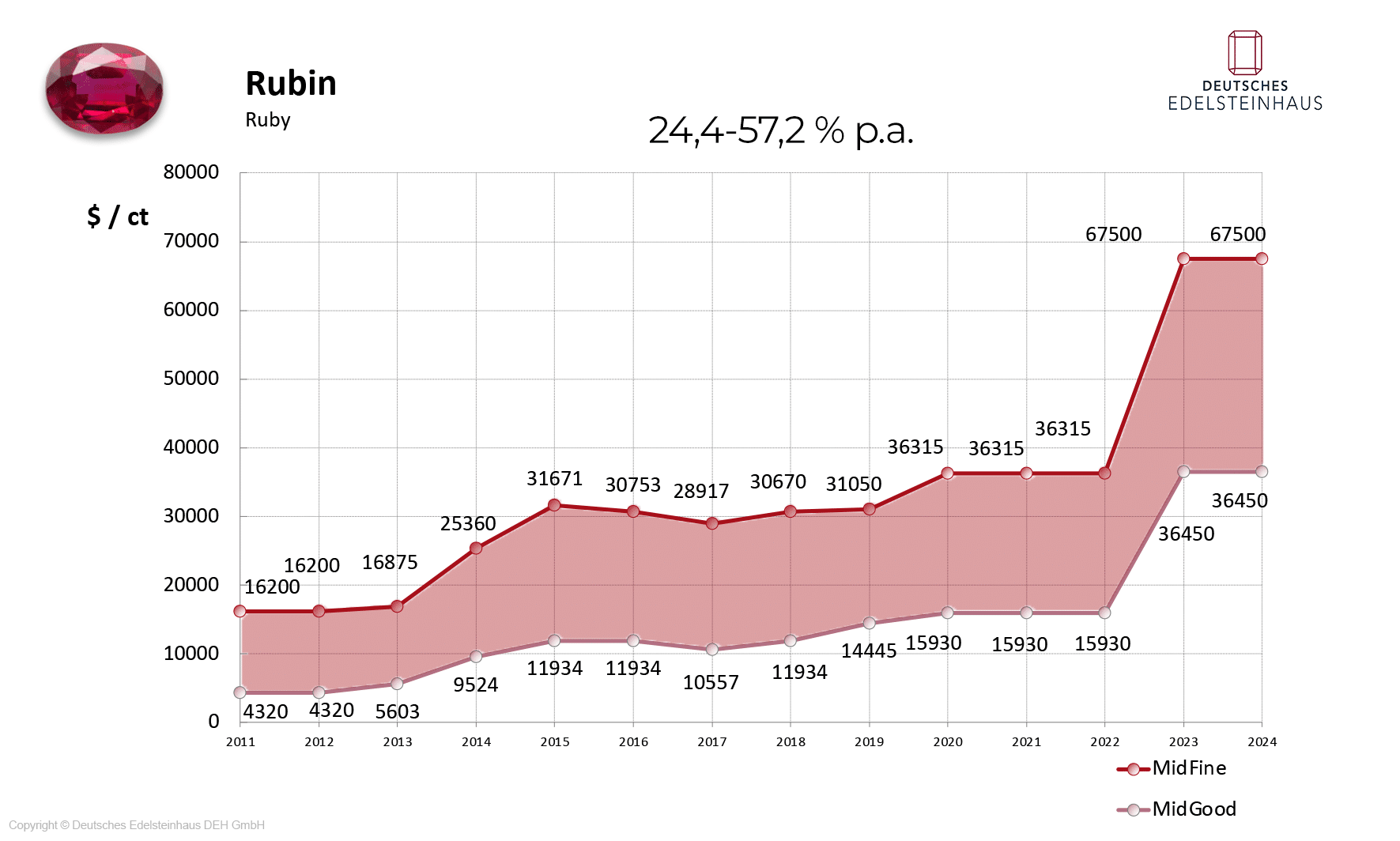

- High value development : Top qualities achieve annual increases in value of 4 – 6%, sometimes even 8%.

- Stability and security : As a tangible asset-based investment, untreated colored gemstones offer long-term stability, protection against inflation, and security in times of crisis.

Performance charts of Ruby, Blue Sapphire, Aquamarine, Pink Spinel, Peridot, Emerald

Who is an investment in colored gemstones suitable for?

Investing in colored gemstones is an excellent way to diversify a portfolio and invest 10–15% of assets in stable, physical assets. With an investment horizon of at least five years, investors benefit from the crisis-proof nature of these tangible assets, which can shine alongside gold.

Ideal for people who focus on sustainable capital accumulation and prefer physical investments that not only retain their value but are also easy to store and pass on discreetly.

What should you consider when investing in gemstones?

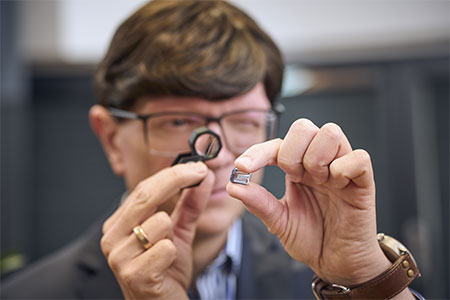

Quality and authenticity are essential, along with the type of gemstone. Quality is assessed based on the 4 Cs: carat (weight), color, clarity, and cut. Only gemstones that achieve top marks in these categories are suitable as investments.

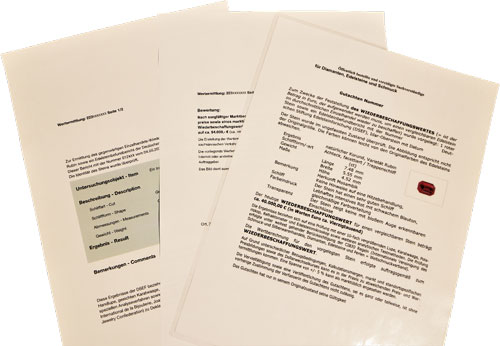

Authenticity should always be verified by various independent, experienced experts. Investors should only purchase gemstones with internationally recognized certificates confirming origin and properties. This ensures clarity and transparency.

Which gemstones should you invest in?

Natural, untreated, high-quality gemstones whose color and clarity have not been artificially altered through processes such as heating, firing, or irradiation are suitable investments. While these processes improve the appearance, they significantly reduce the value of the stones (two-thirds of their value is lost).

Aquamarines, tourmalines, spinels, peridots, and tanzanites are recommended for beginners, offering stable potential for continuously increasing values even with a minimal investment. With the appropriate financial background, rubies, sapphires, and emeralds, also known as the “Big Three,” are certainly the first choice for an investment, both because of their popularity and their attractive performance. Paraiba tourmaline is ideal for experienced investors—it offers outstanding value concentration and is an excellent addition to existing gemstone portfolios.

Untreated gemstones

Connoisseurs pay particular attention to untreated gemstones whose natural color and clarity have not been altered by artificial processes. Such stones are considered particularly rare, which makes them even more valuable to investors and collectors.

Factors of market and value development

Quality and rarity

The quality of a gemstone depends largely on color, clarity, cut, and carat. Unadulterated natural colors, high purity, and a precise cut that optimally showcases the stone’s fire are particularly highly valued.

Origin and certification

Localities such as Myanmar, Colombia, or Sri Lanka are often a sign of quality. An independent certificate from internationally recognized gemological laboratories (e.g., DSEF, Gübelin, SSEF) confirms authenticity and origin. This document is crucial and provides the most important basis for resale.

supply and demand

As gemstone deposits worldwide decline while global demand increases, rare stones benefit from a natural excess of demand – which usually leads to price increases.

Market development and auctions

International auction houses often drive up prices, especially for stones with provenance, excellent certificates, and unique quality. Good contacts and expertise help identify suitable opportunities early on.

Macroeconomic situation

In times of volatile financial markets, gemstones are considered a safe haven, which increases their popularity among investors. Because they are independent of interest rate policy and government debt, their value often remains stable or even increases.

Increased value through future potential

Another important aspect is the increase in value due to the natural scarcity of deposits.

Our list of services is already included in the purchase price for you

Additional aspects for a successful investment

Insurance

High-quality gemstones can be insured as tangible assets. A reputable appraisal and a clear, accompanying valuation report are of immense importance. These certificates provide additional security and are crucial in the event of a claim.

Advice and market knowledge

The market for colored gemstones is complex. Competent advice and expert information help you identify trends and avoid mistakes. The team at Deutsches Edelsteinhaus will help you find the right stone for your investment goals.

Long-term time horizon

As with many tangible assets, a long-term investment in gemstones is particularly worthwhile if you plan to invest it over several years or even decades.

Diversification of your investments

Gemstones should be part of your overall strategy to provide an additional security anchor in your portfolio. Those looking to expand or diversify their portfolio can consider gemstones as a long-term tangible asset alongside well-known asset classes such as real estate, gold, or stocks.

Things to consider when buying and selling gemstones

Purchase: Look for prestigious certificates from independent, globally recognized laboratories (e.g., DSEF, Gübelin, SSEF) that guarantee quality, origin, and authenticity. Also, look for appraisals from recognized institutes. Depending on the type of gemstone, factors such as color, clarity, and cut can significantly influence the price. Independent appraisals provide assurance about authenticity and value.

Selling: Good documentation and certification are crucial to achieving a realistic market price. As mentioned above, a long holding period of 5-10 years is absolutely desirable. However, if you would like to sell your gemstones beforehand, our secondary market concept offers a reputable platform for the secure trading and brokerage of your colored gemstone investment. This ensures that you can maximize your investment.

Our customers are thrilled

The Peculiarities of Investment Colored Gemstones

A gemstone is the crowning result of millions of years of gemmological processes in the most diverse places on earth under ideal conditions.

A blessing of nature in naturalness, beauty and rarity.

This is why these natural, untreated treasures are so valuable and scarce and therefore follow the principle of scarcity (what is really rare and therefore in demand).

The Benefits of Investment Colored Gemstones

We are your safe gateway to the world of investment colored gemstones

Our team of experts is looking for individual investment colored gemstones with potential for our customers worldwide.

There are over 1,200 different varieties (variants) of gemstones. Of these, only 12 come into question as investment colored gemstones (including rubies, emeralds and sapphires). But here too, only if you meet strict quality criteria.

Within this small group, the German Gemstone House only purchases gemstones with the very highest quality criteria.

Specifically: Of the colored gemstone deposits found and mined worldwide each year, only a maximum of 1-3% correspond to the highest quality to be considered an investment colored gemstone.

We only offer these qualities to our customers for purchase.

Get to know some of our customers and their thoughts here. Listen to your positive experiences with us. The speakers are Beate K. (payroll clerk), Hannelore S. (speech therapist and mother), Heike and Erik H. (entrepreneur couple), Dominic L. (head chef).